Christie's - Old Master & British Drawings

Feb. 1st, 2024 - New York

Key Insights

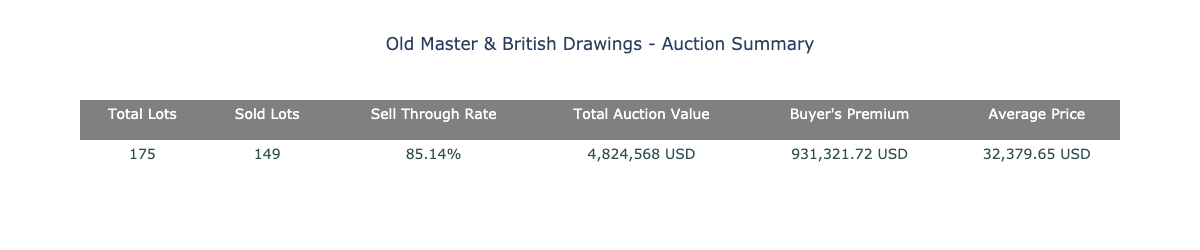

- The auction of Old Master & British Drawings reveals a robust market for classical works, with an 85.14% sell-through rate from 149 sold lots out of 175, indicating strong demand and successful sales tactics, highlighted by a total auction value of $4,824,568 USD and a substantial buyer's premium, suggesting healthy interest from collectors.

- The average price of $32,379.65 USD per lot sold demonstrates a significant level of investment per item, reflective of the historical and artistic value placed on such pieces, and suggests a competitive but accessible market for buyers willing to pay competitive prices for coveted works.

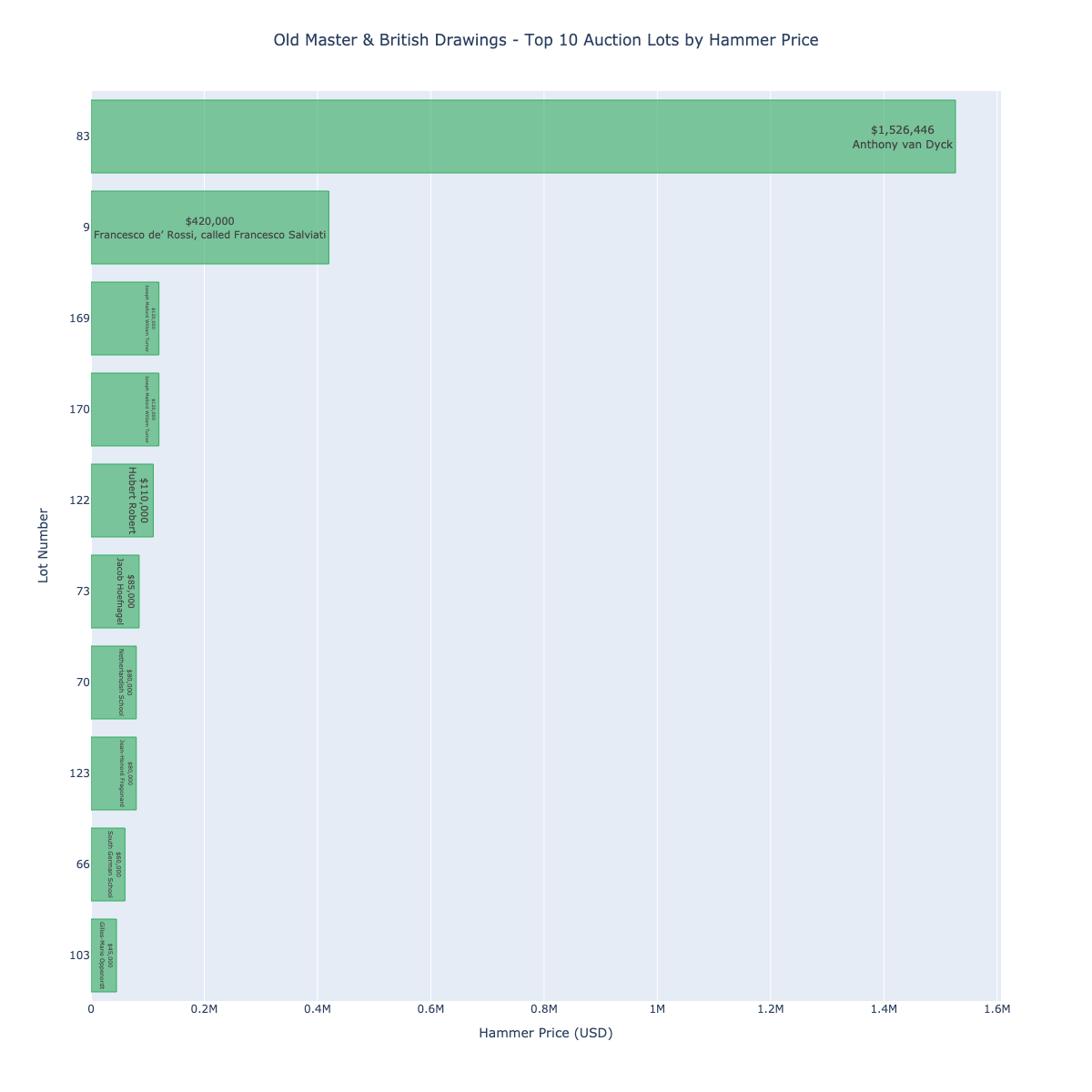

- Anthony van Dyck's "Portrait of Willem Hondius" leading the top 10 auction lots by hammer price at $1,526,446, along with significant sales of other works, illustrates the premium collectors pay for historical importance, rarity, and the renown of the artists, with Turner’s consistent pricing indicating a particular market threshold for British Romantic drawings.

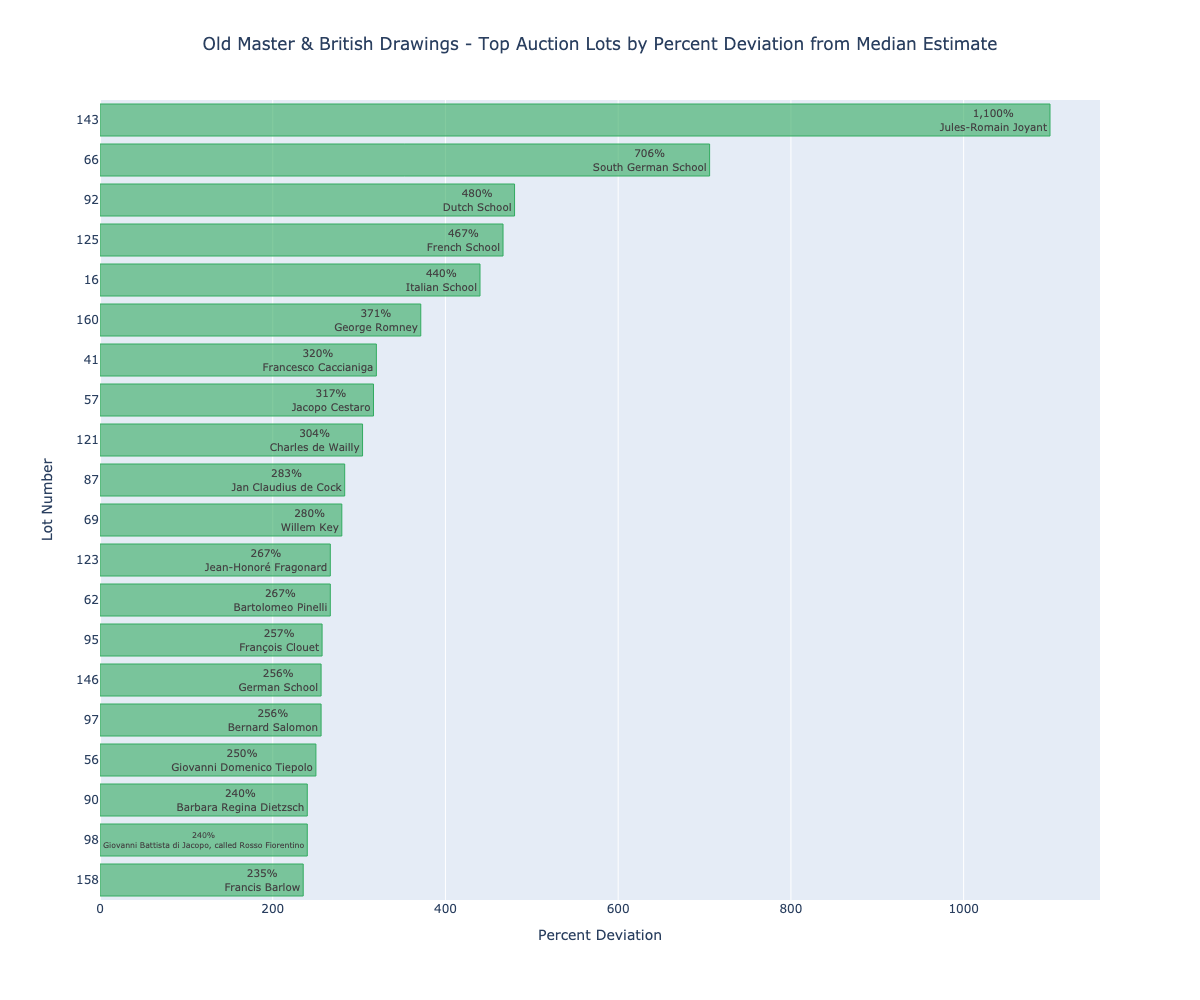

- The chart listing the top lots by percent deviation of hammer price from median estimate showcases unexpected gems outperforming market estimates, such as Lot 143 by Jules-Romain Joyant achieving an 1,100% deviation, suggesting buyer motivations and potential market undervaluation of certain artworks, emphasizing the allure of subject matter like Venice and unique or rare compositions.

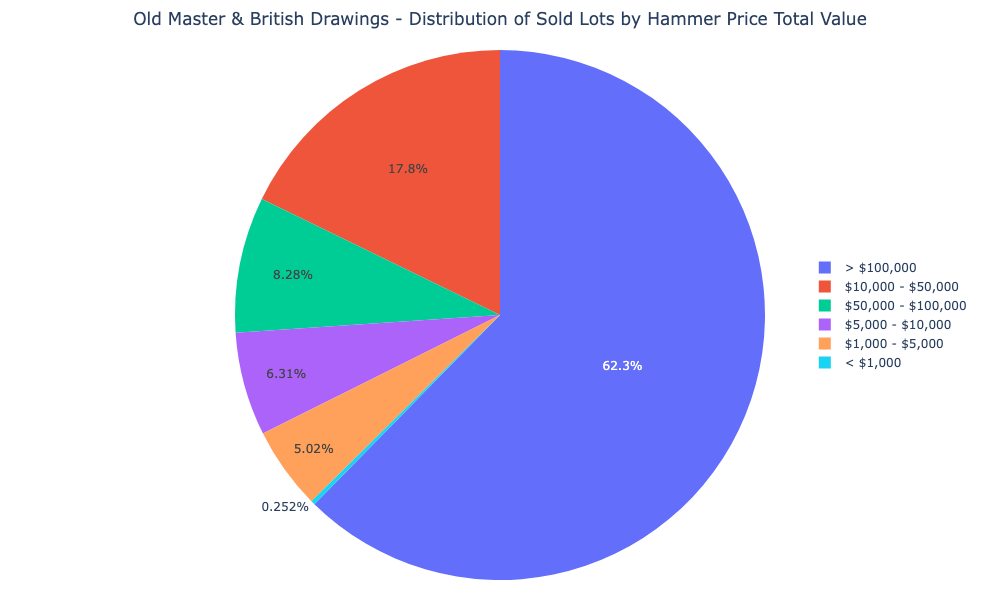

- Analysis of the distribution of sold lots by hammer price total value within the Old Master & British Drawings sector shows a market favoring premium valued artworks, with 62.35% of the total value coming from pieces valued over $100,000, and insights into buying behavior revealing a robust market with multiple entry points, catering from budding novices to established aficionados, with a tendency towards affordable and mid-range purchases.

The auction of Old Master & British Drawings reveals a robust market for classical works, as evidenced by a high sell-through rate of 85.14%, denoting a strong demand and successful sales tactics. The total auction value reached $4,824,568 USD, which suggests a healthy level of interest and financial investment from collectors in these categories. Notably, the buyer's premium totaled $931,321.72 USD, which is a substantial additional revenue for the auction house and an indicator of the final price's inflation above the hammer price.

With 149 sold lots out of 175, this data indicates a favorable acquisition ratio, showcasing an effective selection of works that appealed to the audience and met market expectations. The average price of 32,379.65 USD per lot sold demonstrates a considerable level of investment per item and is reflective of the value placed on such historically significant pieces.

The financial figures provide insight into the overall performance of the auction, suggesting a competitive but accessible market. Particularly, the 85.14% sell-through rate may indicate well-calibrated estimates or a growing collector interest in specific genres or periods represented at the auction. The data suggests a buyer's willingness to pay competitive prices for coveted pieces and the success of the auction house in curating a sale that balanced both rarity and desirability.

The aggregate success of the sale, coupled with the buyer's premium figure, unveils the hidden cost of art acquisition at auction and illuminates the premium that collectors are prepared to pay above the hammer price, a critical factor for new collectors to consider when entering bidding wars.

This auction summary provides a vital snapshot for both existing collectors and newcomers, offering a glimpse into market trends, buyer behavior, and the underlying economic dynamics of the art world. It speaks to the auction house's ability to navigate and capitalize on the collector's appetite for Old Master & British Drawings, and the sustained, if not growing, allure of traditional fine art in a contemporary marketplace.

The chart listing the top 10 auction lots by hammer price for Old Master & British Drawings shows a significant range in the final sale prices, revealing the value placed on pieces due to their historical importance, rarity, and the renown of the artists. Anthony van Dyck's "Portrait of Willem Hondius," lot number 83, leads the list with a hammer price of $1,526,446. The substantial gap between this price and the second highest lot, Franceso de' Rossi's nude studies, lot number 9, at $420,000, illustrates the premium collectors are willing to pay for works by highly sought-after artists from the Old Master category, as well as the impact of a detailed provenance and historical significance on a drawing's market value.

The presence of two works by Joseph Mallord William Turner, lots 170 and 169, which fetched prices of $120,000 each, emphasizes the appealing nature of British watercolors and drawings from the Romantic period. While Turner's renown provides intrinsic value, the equal hammer price for both lots suggests that the market for British Romantic drawings may have a particular price threshold unless additional factors, such as subject matter or provenance, elevate an artwork's rarity and desirability.

The consistency in pricing across different artworks by the same artist, as seen with Turner, may also indicate that the perceived commercial value of certain artists has a cap within the market segment of drawings. However, Hubert Robert's work, lot number 122, selling marginally lower at $110,000, bears witness to a resilient interest in detailed architectural drawings from the Old Master period.

The list concludes with Gilles-Marie Oppenordt's work, lot 103, at $45,000, which is an architectural capriccio—an imaginative composition particularly intriguing to collectors fascinated by shifts in architectural representations through art history.

Interestingly, there is no correlation between the year of creation and hammer price within this selection. Jacob Hoefnagel's 1631 piece, lot 73, commands a lower price at $85,000 compared to more recent, albeit anonymous, pieces. This suggests that, while age might confer some value, the artist's name and the uniqueness of the work generally play a more decisive role in determining auction outcomes. Overall, these sales figures represent the continual collector interest in diversifying and enriching their collections with historically significant artwork.

The top lots by percent deviation of hammer price by median estimate convey a pattern where unexpected gems outperformed market estimates, offering insights into buyer motivations and potential market undervaluation of certain artists or periods.

A standout is Lot 143 by Jules-Romain Joyant, whose artwork "The Grand Canal in Venice, looking towards the Rialto Bridge" achieved an astonishing 1,100% deviation. This striking result suggests a potent combination of the artwork's subject – Venice, which holds perennial allure – and the possible rarity or condition of the piece catapulting it well beyond its estimated value.

Following is the South German School's Lot 66, depicting "A standard-bearer in full armor near a coat of arms in a niche," which fetched 706% over its median estimate. The powerful iconography of armor and historical resonance likely resonated with bidders seeking unique, statement-making pieces.

The Dutch School's Lot 92, featuring "A hippopotamus," saw 480% deviation, indicating a market fascination with exotic subject matter from the 17th century, a period of global exploration that continues to intrigue collectors.

Other notable deviations include Lot 125, a French School "An oarsman" drawing from the 18th century, which exceeded expectations at 467%, showcasing the appeal of maritime and everyday life scenes from this era, and Lot 16, an Italian School piece illustrating "Two urinating Cupids," which saw a 440% percent deviation, perhaps attributed to the whimsical and unusual rendition of classical themes.

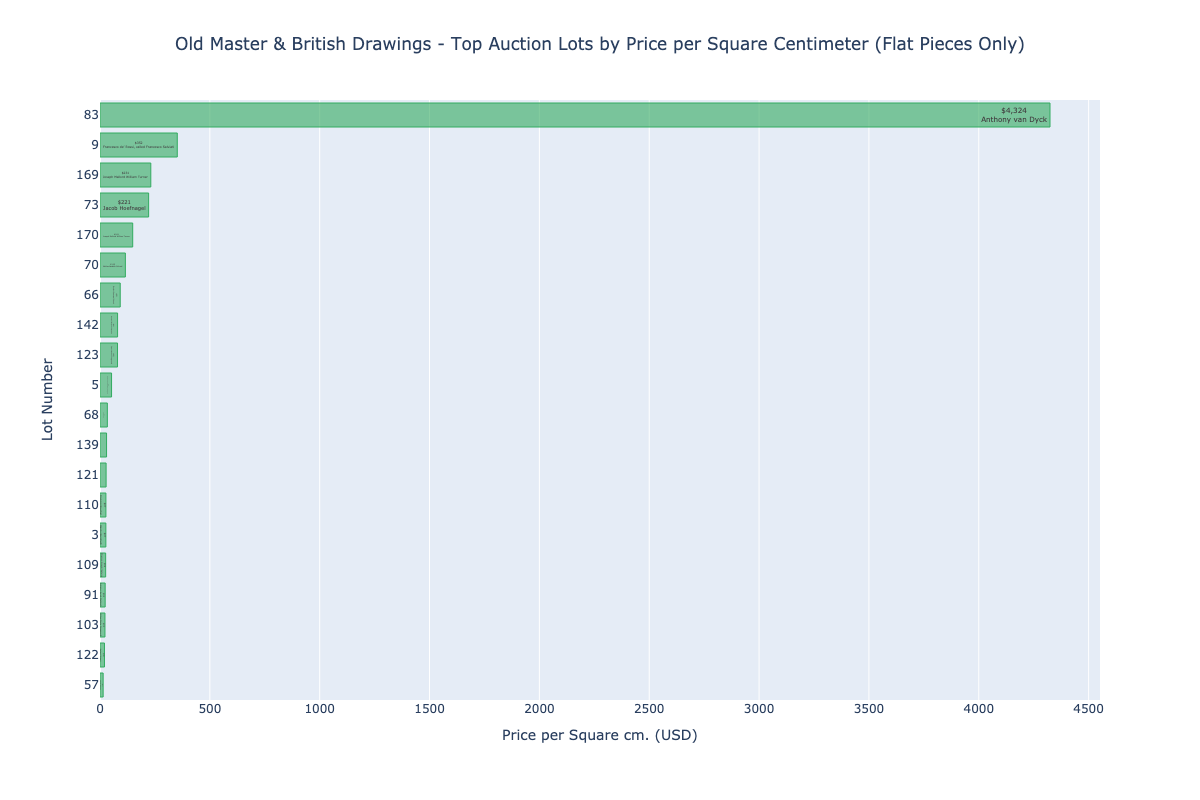

A standout lot is Lot 83 by Anthony van Dyck, "Portrait of Willem Hondius," which achieved the highest hammer price of $1,526,446. The price per square centimeter was $4,324.21, showcasing the premium that collectors are willing to pay for works by renowned artists, especially when the pieces are portraits, which historically carry higher value due to their personal subject matter.

Notably, Lot 9 by Francesco de' Rossi, called Francesco Salviati, features "A nude man in profile to the left (recto); A nude youth seen from behind, pointing upwards (verso)," fetching $420,000. The price per square centimeter stands at $351.76, reflecting the appeal of drawing studies, which offer insight into the artistic process and are becoming increasingly desirable.

Moving to the British sector, Lot 169 by Joseph Mallord William Turner, entitled "Plymouth Citadel, a gale," sold for $120,000 with a price per square centimeter of $231.21. Turner's luminescent watercolour technique and historical significance make his works a solid investment.

Lot 73 by Jacob Hoefnagel, “Apelles painting Campaspe, the Mistress of Alexander the Great,” is noteworthy with a hammer price of $85,000 and a price per square centimeter of $221.35. Dated 1631, its historical value and unique subject matter represents the confluence of art, history, and mythology that attracts discerning collectors.

The sale of Lot 170, another work by Turner, "Cologne from the river," at $120,000, price per square centimeter of $148.88, reinforces Turner's market stability. The consistent interest in his works points to a maintained collector base, even beyond the top-tier sales.

Overall, higher prices per square centimeter often correlate with a mixture of the artist's renown, the historical significance of the work, and the aesthetic qualities that resonate with collectors. The trends observed suggest that, while the allure of big names like van Dyck and Turner continues, there is also a keen market appetite for works that offer biographical and process insights into the artists' oeuvre.

Analyzing the distribution of sold lots by hammer price total value within the Old Master & British Drawings sector, it is evident that the market favors premium valued artworks, as denoted by the concentration of total value in the upper price echelon. A staggering 62.35% of the total value comes from art pieces valued over $100,000, suggesting a strong preference for high-caliber art among collectors and institutions, likely due to their historical significance, rarity, and the esteem of the artists within this genre.

Moving to the middle tier, lots in the $10,000 - $50,000 range account for 17.78% of the total value. This demonstrates a healthy middle market where there is significant activity, potentially from seasoned collectors looking for quality works with investment potential, that may not have the same level of prestige or scarcity as those in the highest price range.

The lower end of the market, while vast in the number of lots, contributes less to the total value. The $5,000 - $10,000 and $1,000 - $5,000 brackets make up 6.31% and 5.02% respectively. Works falling under $1,000 represent a mere 0.25% of overall value, which reflects the reality that entry-level lots may involve lesser-known artists, works with condition issues, or pieces with less historical importance, appealing to novice collectors or those with more modest budgets.

Interestingly, the $50,000 - $100,000 bracket accounts for only 8.28% of the total value, suggesting a gap in the market or possibly a precise threshold where the perceived value and collector interest significantly increases.

These numbers illustrate that while Old Master & British Drawings offer opportunities at various investment levels, the market's financial bulk resides at the high end. This trend generally indicates confidence in the lasting value and cultural importance of top-tier works within this category. It could also reflect a more concentrated interest among collectors who have the means and desire to own a piece of art history that is both a financial asset and a prestige object.

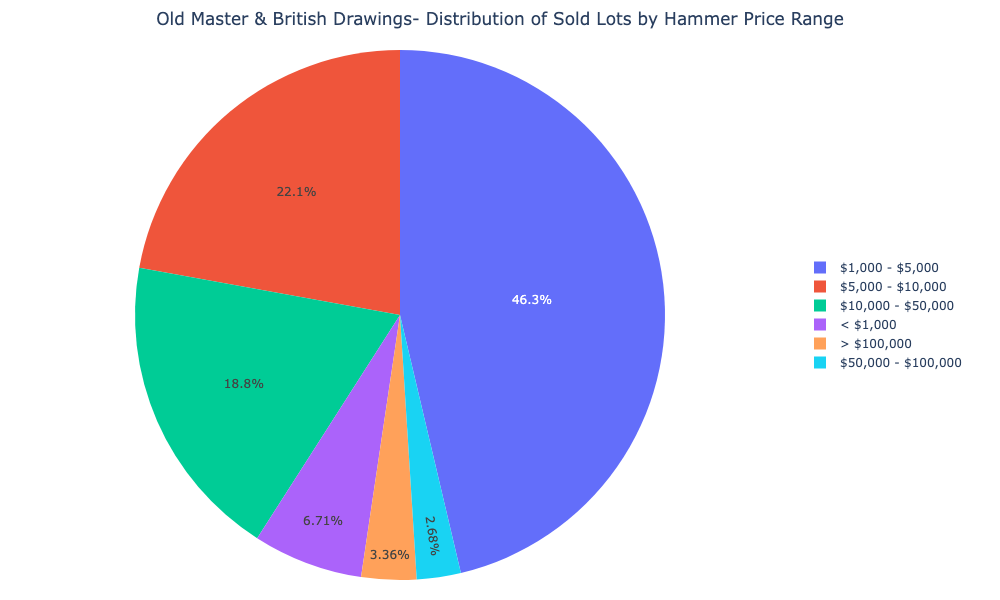

The distribution of sold lots by hammer price range in the realm of Old Master & British Drawings sheds light on the buying behaviour within this sector of the art market. The predominance of lots within the $1,000 - $5,000 range, accounting for 46.31% of the sales, exemplifies a sweet spot for collectors who are perhaps more conservative in their investments or are perhaps looking to diversify with multiple assets rather than sinking capital into singular, high-cost pieces.

The second most populated category with 33 lots is the $5,000 - $10,000 range, showcasing that there is a significant drop-off as price increases, yet a substantial market exists for mid-range works. The notable drop to 28 lots for the $10,000 - $50,000 bracket could indicate a more selective buying pattern, where collectors are possibly seeking pieces with rising potential or established historical value.

At the upper echelons of the market, the relative rarity of transactions is evident, with the $50,000 - $100,000 and > $100,000 price ranges cumulatively representing just 6.04% of sold lots. High-end collectors and institutions might be the actors in this sphere, seeking distinguished pieces for long-term appreciation or as cornerstones of curated collections.

What is particularly insightful is the sub-$1,000 market, holding 6.71% of sales. This could be attributed to works by lesser-known artists or those with condition issues, serving as entry points for new collectors or as tactical acquisitions for dealers looking at restoration and value-add strategies.

Overall, the distribution underscores the Old Master & British Drawings segment as one with multiple entry points, from the budding novice to the established aficionado, with a clear tendency towards affordable and mid-range purchases that signify a robust market with room for growth and opportunity.