Christie's - Ordinal Maxi Biz (OMB)

April 9th to 16th, 2024 - New York

Executive Summary

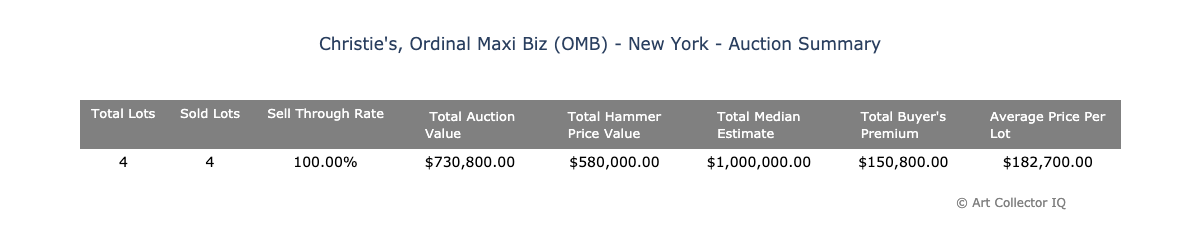

The "Ordinal Maxi Biz (OMB)" auction represents a paradigm shift in the art market, prominently featuring digital artworks linked to blockchain technology. With Tony Tafuro and Berkin Bags leading the sales, the auction painted a picture of a market in transition, embracing new media and the digitization of value. Despite the high sell-through rate of 100%, the lots sold notably underperformed against their median estimates, indicating a disconnect between expected and realized values in this emerging sector. The total hammer price of $580,000 fell short of the $1,000,000 median estimate, yet the total auction value, including the buyer's premium, reached $730,800, showing a healthy final acquisition cost for buyers.

Key Insights

- Digital Art's Market Position: The auction confirms digital art's growing presence in the marketplace, particularly art interfacing with blockchain and Bitcoin.

- Tony Tafuro's Dominance: Tafuro's works dominated the auction, but prices did not meet estimates, highlighting the challenges in valuing digital art.

- Youthful Emergence: The success of Berkin Bags illustrates collector interest in younger artists and innovative digital expressions.

- Cautious Bidding: The conservative hammer prices across lots suggest buyer caution in an evolving market not yet fully understood.

Auction Overview

The Christie's "Ordinal Maxi Biz (OMB)" in New York auction boasted a perfect sell-through rate of 100%, with all four lots available being sold. While such a high sell-through rate is commendable, further analysis of the financial details reveals a nuanced picture. The total hammer price value for the auction was $580,000. This figure, while substantial, fell short of the total median estimate of $1,000,000 by 42%, indicating that the lots sold for less than what was anticipated. This discrepancy suggests that the lots may have been overestimated, or that buyer appetite was lower than expected.

Despite the underperformance relative to the median estimates, the total auction value, which includes a buyer's premium typically around 26%, reached $730,800. The additional premium suggests a healthy buyer's interest in terms of final purchase prices, which includes the fees they are willing to pay over the hammer price.

The average price per lot came in at $182,700, a robust figure that underscores the value and desirability of the individual pieces. However, the contrast between this average price and the shortfall from the estimated values suggests that while the lots were valuable, market conditions or valuation misalignments may have played a role in the lower hammer prices.

Lot Analysis

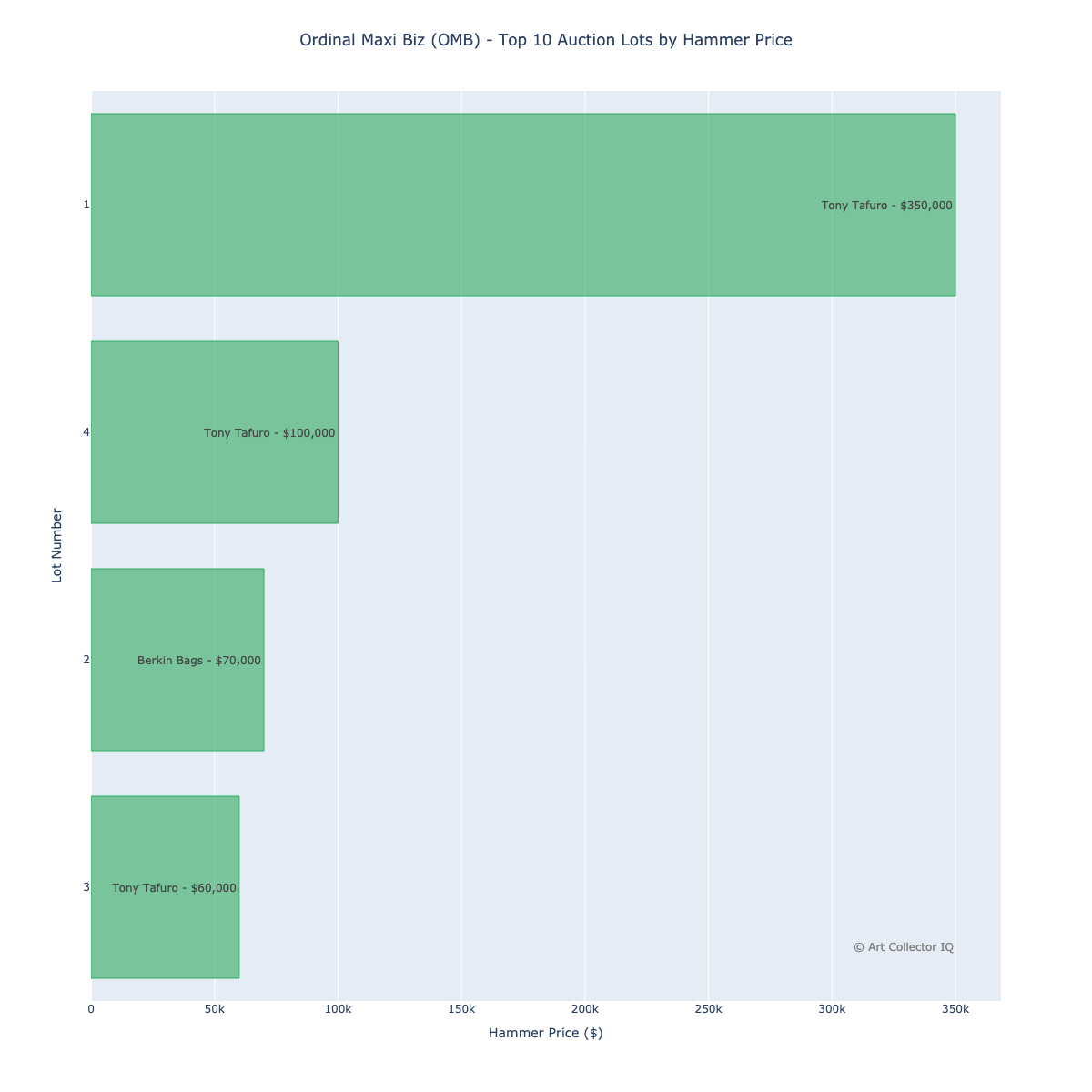

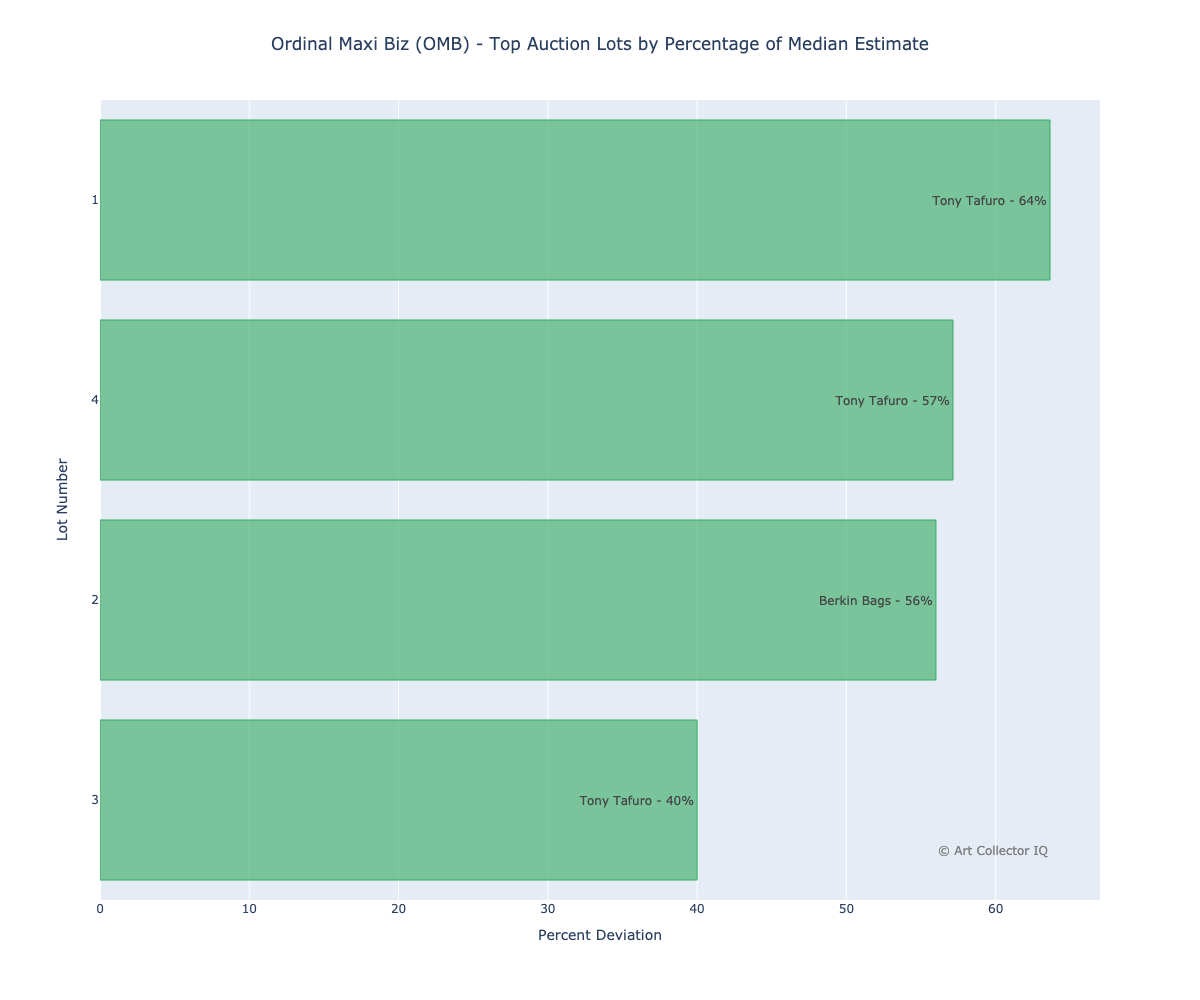

Lot 1 by Tony Tafuro, titled "Red, Blue, Green, and Orange Eye OMB Set," reached 64% of its median estimate, with a hammer price of $350,000 against an estimate of $550,000. Although it was the highest hammer price in the auction, it suggests that the appetite for this particular piece was measured, with collectors perhaps wary of over-investing in a market segment that is still stabilizing.

Lot 1 by Tony Tafuro, titled "Red, Blue, Green, and Orange Eye OMB Set," reached 64% of its median estimate, with a hammer price of $350,000 against an estimate of $550,000. Although it was the highest hammer price in the auction, it suggests that the appetite for this particular piece was measured, with collectors perhaps wary of over-investing in a market segment that is still stabilizing.

Lot 4, another work by Tafuro called "This is Me," and Lot 3, titled "Artists Journal," secured hammer prices of $100,000 and $60,000, translating to 57% and 40% of their median estimates, respectively. These lots further imply that Tafuro's work attracted cautious yet consistent interest, possibly reflecting the evolving nature of digital art's valuation.

Lot 2, presented by Berkin Bags, is "Recording In Progress." This lot achieved a hammer price of $70,000, which is 56% of the median estimate of $125,000. The performance of this lot by a relatively younger artist points towards a growing curiosity and willingness to engage with emerging digital art forms, though again, the final price fell short of expectations, echoing a market trend of conservative bidding on newer media.

These figures are indicative of a broader trend in the auction of digital art linked to cryptocurrency, where estimates may not yet align with market understanding or confidence. The deviation from estimated values could also reflect the nascent state of digital and blockchain-based art in the traditional auction setting.

Artist Analysis

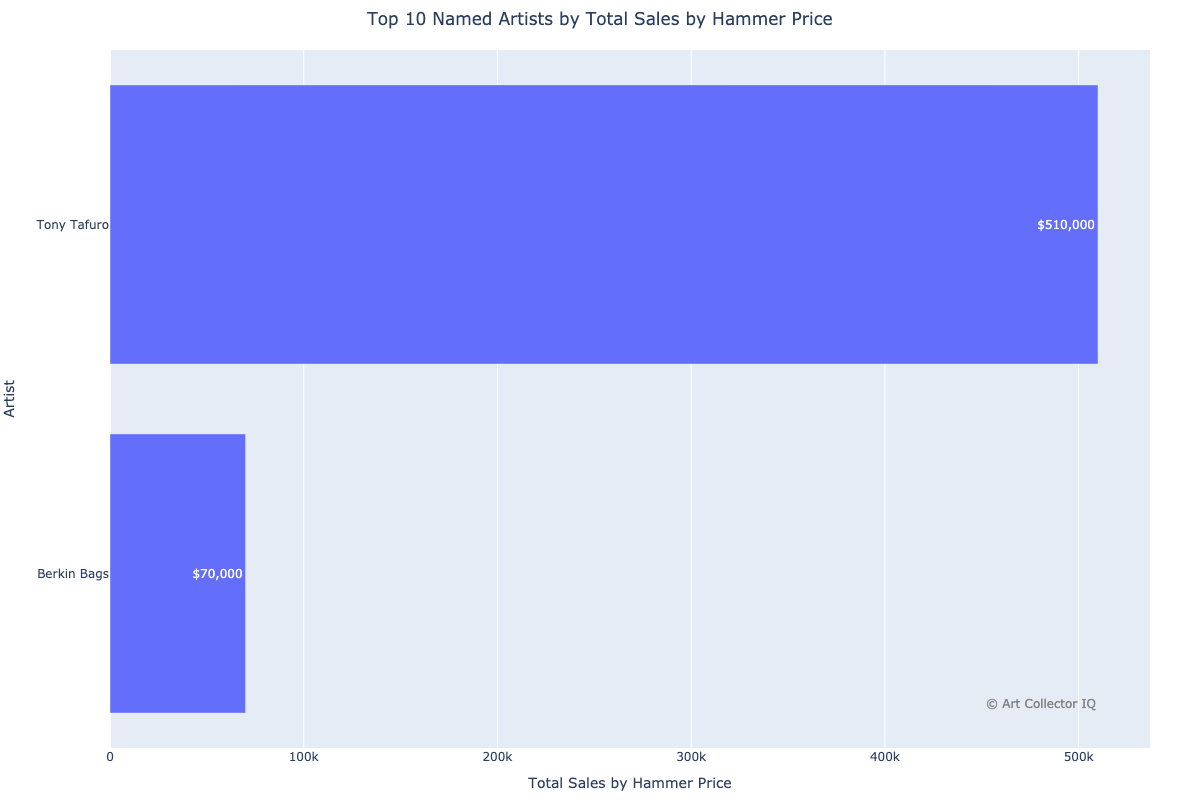

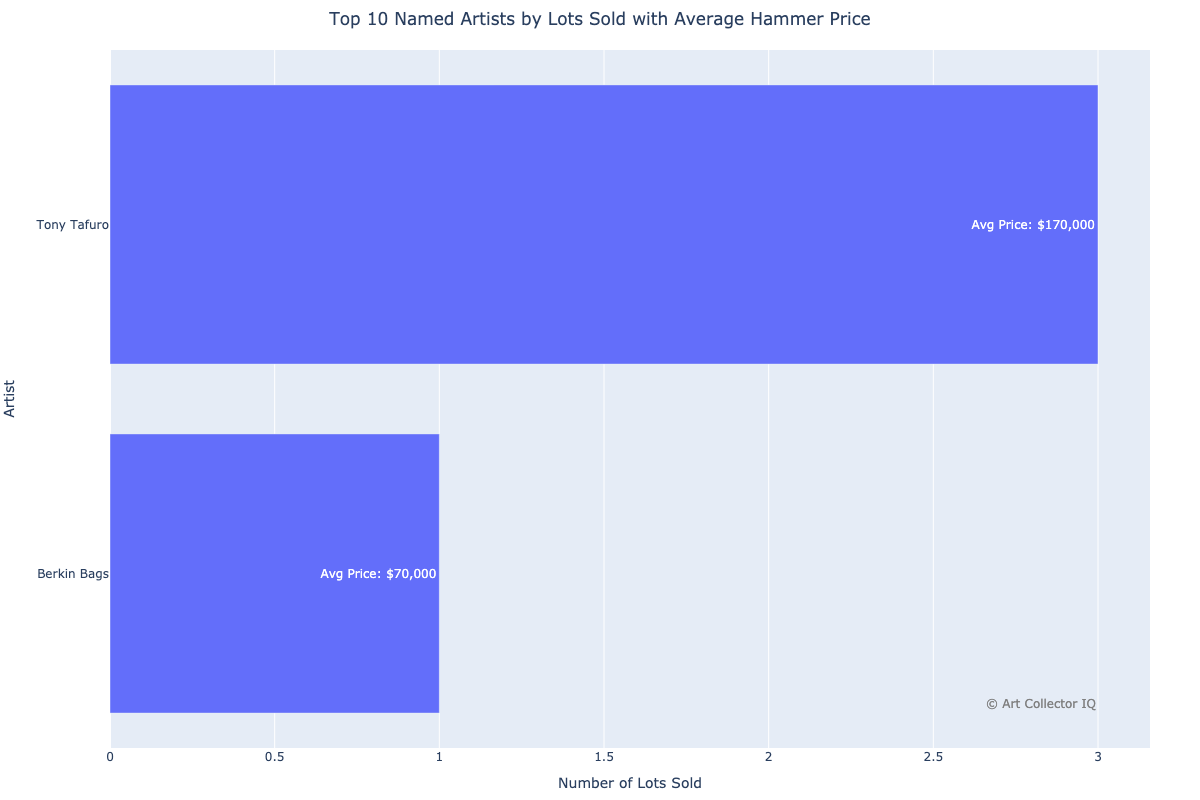

Tony Tafuro comes to the forefront with three lots sold, accruing a total of $510,000 in hammer prices, and averaging $170,000 per lot. This places Tafuro as the leading artist of the auction in terms of total sales and demonstrates a solid collector interest in his work. The average price per lot underscores a substantial valuation of his art, although each sold for less than the median estimate, as previously noted. Tafuro's work engages with the innovative intersection of digital art and blockchain, a factor that likely contributes to his prominence within the auction.

Berkin Bags, a younger artist with a single lot sold, contributed $70,000 to the auction's hammer price total, equating to an average price that matches the lot's hammer price. The successful sale of Bag's work "Recording In Progress" could indicate that collectors are willing to invest in emerging artists who are exploring new digital mediums.

The artist analysis presents several implications:

- Tony Tafuro's Position: Tafuro's digital art is a mainstay in this auction, indicating a robust interest in digital artwork tied to cryptocurrency. His average price per lot shows that while his work commands significant value, there remains a gap between estimated and realized prices, perhaps reflective of the evolving digital art valuation landscape.

- Emerging Talent: Berkin Bags' entry into the auction and successful sale points to an appetite among collectors for new and innovative art forms. This suggests that the art market is responsive to novel expressions of digital media and supports up-and-coming artists.

- Market for Digital and Crypto-Art: The presence and performance of Tafuro and Bags underscore a burgeoning market for art forms that resonate with current technological themes, especially around blockchain and digital assets.

Collector Recommendations

- Monitor Digital Art Trends: Collectors should stay informed on the latest developments in digital and crypto-art as this sector matures.

- Valuation Challenges: Be aware of the valuation discrepancies for digital artworks and approach estimates with a critical eye.

- Support Emerging Artists: Consider investing in up-and-coming artists like Berkin Bags, who represent the burgeoning movement of digital art.

- Diversify With Caution: While diversifying into digital art, collectors must do so with caution and due diligence given the nascent nature of this market segment.

- Engage with Novelty: Engage in the new frontier of art that intersects with technology, recognizing its potential for growth.